Small-caps are feeling the pain

Many investors don't pay much attention tosmall-cap stocks, but they play a vital role in gauging the health of the economy. Many large-cap stocks have global scope, and their share prices therefore more often represent the health of the global economy. By contrast, smaller companies are more likely to focus on their home markets. That means U.S. small-cap stocks often have exposure only to the U.S. economy.

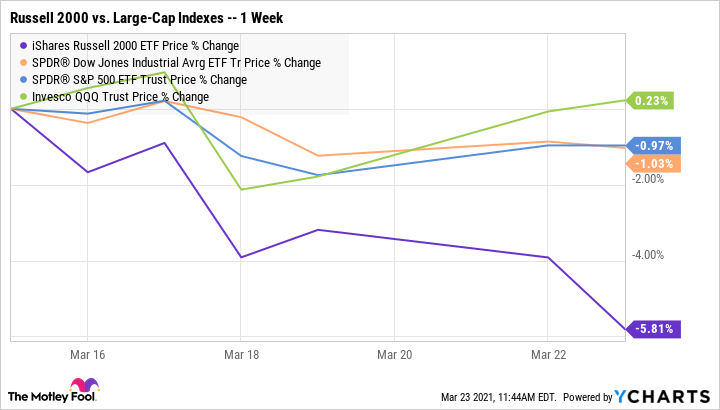

It's therefore troubling to see theRussell 2000 Indexfall sharply over the past week. Looking back over the past week, even as the major large-cap indexes have stayed in a tight range, varying from being up slightly to down around 1%, the Russell has seen a big drop of nearly 6%. That's already a minor correction in many investors' eyes.

Some of the downward move also relates to the heavier concentration of energy stocks among small-caps. Large-cap indexes have very little energy exposure, but sizable drops in companies likeLaredo Petroleum(NYSE:LPI)andNabors Industries(NYSE:NBR)over the past week have had an impact on the Russell.

Reverting to the mean

The counterargument to worries about small-cap stocks is that when you look over even slightly longer time frames, they're still doing relatively well. So far in 2021, the Russell has gained almost 13%, which is more than double what investors in the Dow and S&P have seen. A slight pullback for the small-cap benchmark from its peak outperformance earlier this month certainly doesn't mean that a stock market crash is imminent. Short-term swings happen all the time.

Nevertheless, with comments from Treasury Secretary Janet Yellen and Fed chair Jerome Powell expected later Tuesday, Wall Street will still be watching the overall market and small-cap stocks in particular. If this disparity continues, it won't be a good signal for those hoping for a strong recovery in Main Street U.S. businesses in 2021.