It’s crucial to devise a strategy that you can live with through a bear market

It was on Oct. 9, 2007, 14 years ago this week, that the stock market hit its bull market high prior to the beginning of the Financial Crisis-induced bear market.

I am willing to bet that the last thing on your mind that day was whether a new bear market was beginning. Instead, you undoubtedly were sharing in the exuberance that accompanied yet another new bull-market high. The S&P 500 was 120% higher than where it had stood at the beginning of that bull market, five years previously.

And, yet, one of the worst bear markets in U.S. history was beginning on that very day. The S&P 500 over the subsequent 16 months would lose 55%.

This walk down memory lane is important because it serves as a reminder that bull market tops aren’t recognized in real time. It’s only after the fact that it becomes clear that the bull market has ended.

Many clients strenuously disagree with me about this, insisting that they in fact did have a good sense the bull market was topping out in October 2007. But they almost certainly are rewriting history, which is understandable. It’s human nature to rewrite the past to make it seem obvious that events would unfold as they did.

But the beginning of the 2007-2009 bear market was anything but obvious in the moment.

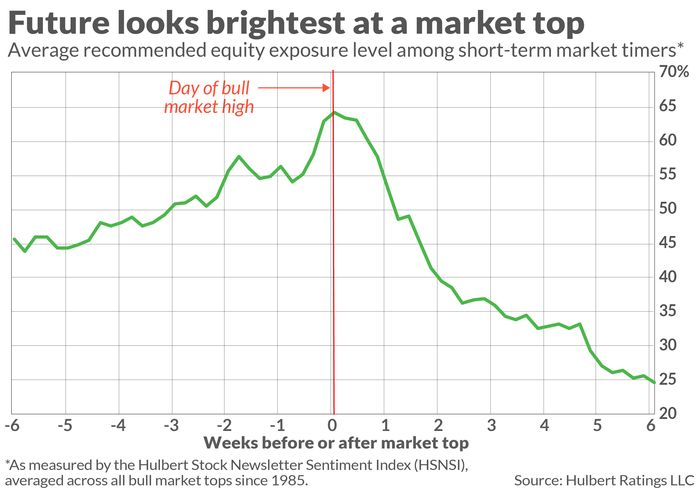

If you have any doubt, consider the average recommended equity exposure among a subset of nearly 100 short-term stock market timers my firm monitors on a daily basis. (This average is what’s represented by the Hulbert Stock Newsletter Sentiment Index, or HSNSI.) On average, the HSNSI reaches its highest level on the very day the bull market tops out.

This is illustrated in the accompanying chart. It averages the HSNSI over the six weeks prior and six weeks subsequent to every bull market top of the last 40 years (per the calendar maintained by Ned Davis Research). As you can see, the HSNSI rises 20 percentage points over the final six weeks of the average bull market, and then plunges 40 percentage points over the first six weeks of the subsequent bear market.

In other words, professional market timers on average are most optimistic on the very day they should be most pessimistic. They are professionals who follow the market all day, every day. If they can’t do better, then what makes you think you can?

Comments of market timers

I think these statistics make a compelling case. But to add anecdotal icing to the cake, consider a representative sampling of comments made by newsletter editors on the exact day of the October 2007 market top, or in the days immediately prior:

- “If you listen carefully, you can hear the rumbling. That rumbling is the distant thunder of the third phase of this great bull market… I see the good times rolling, I really do.”

- “It’s been a while since I’ve felt so confident about the potential for making some great gains with our serious money. So, if you haven’t done so already, it is essential that you get your money into this [stock] market as quickly as possible. Time waits for no man, and your money is waiting on you. So go to it.”

- “The global bull market in stocks not only continues, but… it’s also entering a strong phase… Now that the Fed has waved the flag that interest rates are going lower, there’s really nothing holding the market back.”

- “Dow 16,000 here we come… [I]t appears to us that the stock market is off to the races for the next 3 to 6 months.” [The Dow on the day of the October 2007 bull market top was 14,165.]

- “The risk of a cyclical bear market decline in excess of 20% is not on the radar screen.”

- “The longer-term bull market is intact… You should be looking to buy on any weakness.”

Their exuberance is palpable, isn’t it? And odds are overwhelming that that’s how you felt too on that day—regardless of what story you may be telling yourself today.

Investment lesson

The investment implication is clear: Do not count on being able to reduce your equity exposure in order to sidestep a bear market.

This is why you should devise and then follow a strategy you can live with through a bear market. It won’t necessarily make as much money as the theoretical maximum you could make if you were to be 100% invested during bull markets up until the exact day of the S&P 500’s top, and then moved to be 100% in cash for the duration of the bear market. But no one achieves that theoretical maximum in the real world.

The perfect is the enemy of the good, in other words.

For the record, I have no idea whether a bear market has started. It’s been over a month now since the S&P 500 hit what so far has been its bull market high, and it is currently trading nearly 3% lower than that high.

But if it has started, we won’t know for sure until many months from now and when the market is a whole lot lower.