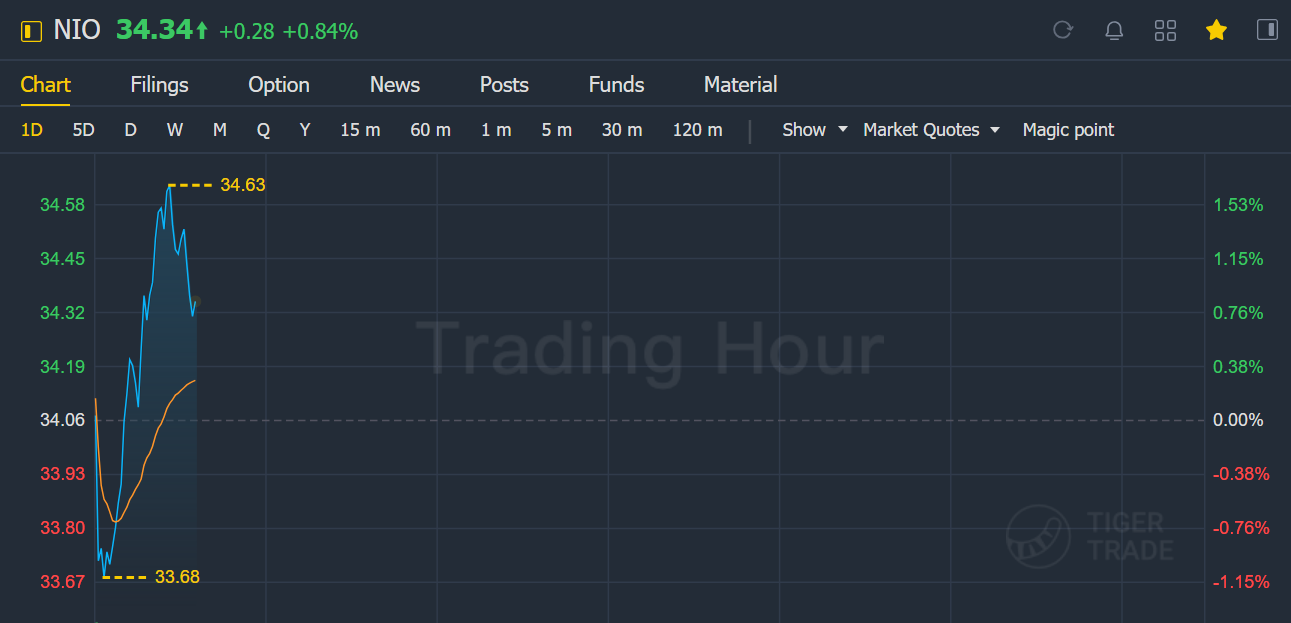

Today NIO shares starts rising as renewed its key joint manufacturing agreements.

NIO Inc. (NIO) has renewed its manufacturing agreements with Jianghuai Automobile Group (JAC) and Jianglai Advanced Manufacturing Technology (Jianglai) for the joint manufacture of NIO vehicles and associated fee arrangements.

JAC, a state-owned vehicle manufacturer, presently manufactures NIO vehicles at its Hefei JAC-NIO plant, which was specifically set up for NIO vehicles.

Jianglai is a joint venture between NIO and JAC for operations management. NIO holds a 49% stake in this JV.

Under the agreement, JAC will continue manufacturing NIO’s ES8, ES6, EC6, and ET7 models, as well as other models in its pipeline, until May 2024.

Furthermore, JAC will increase its annual production capacity to 240,000 units to satisfy the rising demand for NIO vehicles. While NIO will take responsibility for vehicle development, engineering, supply chain, quality management, and manufacturing processes, Jianglai will be in charge of parts assembly and operations management.

Significantly, the new agreement will enable NIO to benefit from economies of scale and future improvements in manufacturing processes.

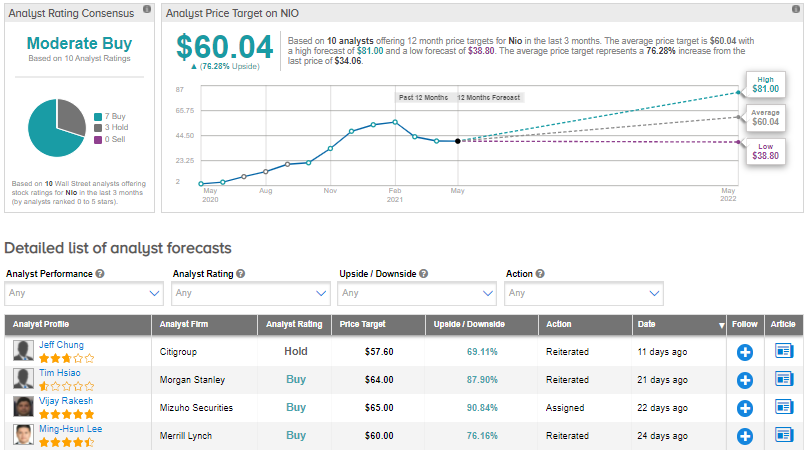

On May 13, Citigroup analyst Jeff Chung reiterated a Hold rating on the stock with a $57.60 price target (69.1% upside potential).

Commenting after interacting with NIO management, Chung noted that the shortage of chips was a key constraint for vehicle production in May but management sees the situation improving in June or July.

Consensus among analysts is that NIO is a Moderate Buy based on 7 Buys and 3 Holds. The average analyst price target of $60.04 implies 76.3% upside potential.

Shares have dropped about 36.3% so far this year.