United Parcel Service, Inc. (UPS), the largest global package delivery company and provider of supply chain management solutions, hosted an investor conference announcing the company’s Strategic Priorities, 2023 financial targets, and new ESG Targets. Shares plunged 4.2% to close at $201.06 on June 9, as the outlook fell short of investor expectations.

Under the company’s Customer First, People Led, Innovation Driven strategy, the company aims to achieve a Net Promoter Score (NPS) of 50 or higher by 2023, increase the “likelihood to recommend” target to 80% or higher, and consistently enhance shareholder value by engaging in dividend payouts and share buybacks. (See UPS stock analysis on TipRanks)

The company’s FY 2023 financial targets include projected total revenue in the range of $98 – $102 billion, total adjusted operating margin of 12.7% to 13.7%, cumulative Capex (from 2021 to 2023) of $13.5 – $14.5 billion, and adjusted return on invested capital (ROIC) of 26% to 29%.

As for the company’s newly established ESG targets, UPS undertakes to be carbon neutral across scope 1, 2, and 3 emissions in its global operations by 2050.

The company also provided interim 2035 environmental sustainability targets which include a 50% reduction in CO2 per package, 100% renewable electricity in facilities, and up to 30% use of sustainable aviation fuel in its global fleet.

Carol Tomé, the company’s CEO said, “We are creating a new UPS, rooted in the values of the company. Our strategic priorities are evolving to reflect the changing needs of our customers and our business, and what matters most to our stakeholders.”

Following the announcement, Oppenheimer analyst Scott Schneeberger assigned a Buy rating to the stock with a price target of $222, implying 10.4% upside potential to current levels.

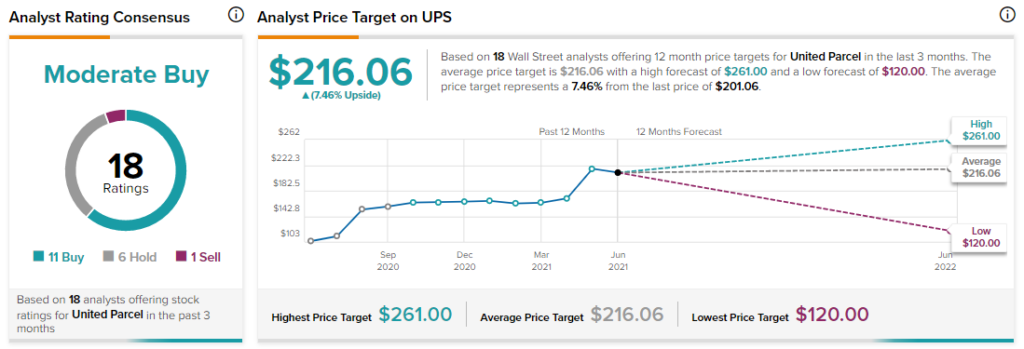

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys, 6 Holds, and 1 Sell. The UPS average analyst price target of $216.06 implies 7.5% upside potential to current levels. Shares have gained 88.6% over the past year.