United Airlines (UAL) is getting ready for the coming winter. The airline plans to add about 150 daily flights to warm-weather destinations in the U.S. for winter holiday travel. Additionally, the airline plans to offer 30% more flights to Latin America’s leisure destinations than it did in 2019. United stock rose 2.90% on Friday to close at $51.10.

United’s expanded winter schedule will begin in November and run through March 2022. The U.S. destinations the airline plans to serve with more flights during winter include Las Vegas, Jacksonville, Ft. Myers, San Diego, Charleston, Phoenix, and Palm Beach. In Latin America, the company plans to offer more flights heading to Belize City, Cozumel, Liberia, and Nassau.

"As pandemic restrictions ease, people are becoming more confident in planning travel further in advance, so we want to make sure to offer our customers as much choice as possible," said Ankit Gupta, United’s Vice President of Network Planning.

The airline is expanding its capacity to meet the growing demand for travel. It has ordered more than 270 mainline jets to add to its fleet. (See United Airlines stock charts on TipRanks).

UBS analyst Myles Walton recently reiterated a Buy rating on United stock with a price target of $67. Walton’s price target suggests 31.12% upside potential.

The analyst noted that United’s bulk order represents more than just an aircraft purchase. Instead, management explains it as a plan to align the airline’s network, fleet, and products to its hubs. Walton further observes that the main goal of the purchase is to "upguage" United’s current fleet.

"The plan calls for their average North American flight to go from 104 seats to 134 seats in 2026 which will be a big contributor to their goal of reducing CASM-ex by 8%," commented Walton.

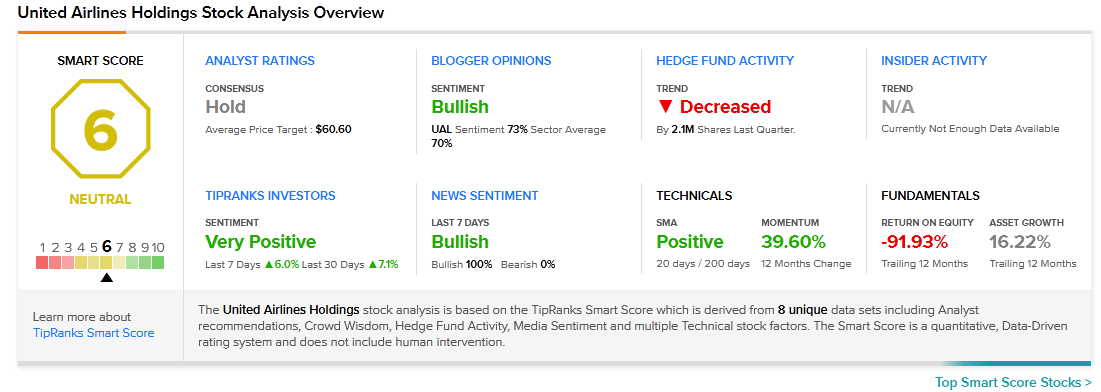

Consensus among analysts is a Hold based on 6 Buys, 8 Holds, and 2 Sells. The average United Airlines price target of $60.60 implies 18.59% upside potential to current levels.

UAL scores a 6 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.