Stock futures are a mixed bag headed into Thursday's session, with Amazon.com's results in the spotlight for later. There also also has been some damage-control moves by Chinese officials after a series of regulatory blows sent investors in technology and other shares from the country running for cover.

Investors are also considering over the outcome of the Federal Reserve meeting, which left the status quo in place for interest rates and asset buys. That's as some, like Deutsche Bank strategist Jim Reid and his team, "see the beginning of an initial nod toward a tapering of asset purchases at some point."

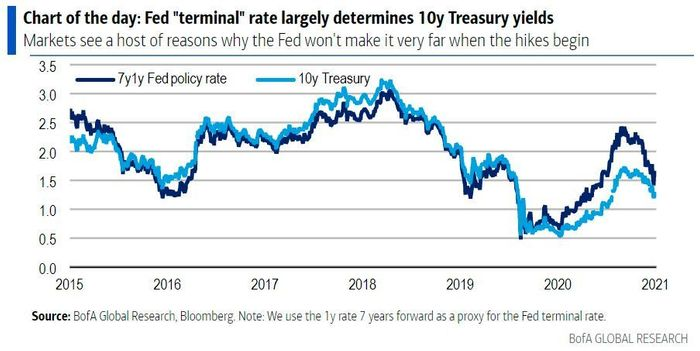

Another burning question for investors right now, why are 10-year rates so low? Our call of the day comes from Bank of America strategists who think they've cracked it.

"Clients point to strong growth -- currently tracking 4.1% for 3Q -- and CPI inflation running above 5%. But we think the rates market is focused on 2023 and beyond, and are increasingly questioning the ability of the Fed to deliver a substantial hiking cycle," wrote lead strategist Ralph Axel and the team.

Traders don't see the Fed repeating the 2015-2018 hiking cycle, which brought the policy rate band to 2.25%-2.50% in December 2018, and a peak 10 year rate of 3.2% in November 2018, said the strategists.

For equity investors, the yield is important as lower levels help to boost tech stocks in particular as they make borrowing easier for those types of companies. If rates start going up, some could fear it will draw money out of the stock market as investors seek better returns.

Bank of America doesn't see a sharp rise in rates such as was seen in the first quarter -- driven by positive vaccine surprises and fiscal stimulus -- but they see scope for modestly higher rates in the next six to 12 months. "We have not changed our forecast for 10y rates at 1.9% by year-end, but downside risks to our forecast have increased," he said.

Axel said they are keeping a keen eye on next week's payroll reports that is said will help "set the tone for the rest of the summer."

"If jobs are strong and inflation becomes more widespread across the CPI basket, and the Fed does not react hawkishly to strong data, we think there is scope for higher rates as long as disruptions due to COVID-19 remain well contained. These are the fundamental ingredients we will need to regain confidence in our 1.9% call for 10y rates," they said.

A weak jobs report next week, though would fuel worries of "moving past peak growth, peak inflation, peak stimulus and perhaps even peak interest rates."