Last year's winners haven't been doing so hot. On Monday, the ARK Innovation ETF (ARKK), which surged 153% in 2020, closed higher for only the second time in 14 sessions, and has dropped 24% this year. "We believe you should invest based on what you see, and what you see is high multiple, unprofitable tech get slaughtered with the selling starting to seep into other areas," says Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management.

Michael Darda, chief economist and market strategist at MKM Partners, has a similar warning, but first he wanted to give a reality check. After the Powell Pivot and the signal the head of the Federal Reserve likely supports faster tapering, he says some investors are worried the central bank may tighten too much. "There is virtually no evidence that the Fed is getting in front of the curve in a destabilizing way," replies Darda. "Bond market inflation expectations pulling back from 'too high' levels to 'still elevated' levels relative to an average 2% per annum path for inflation do not represent a material tightening in monetary policy."

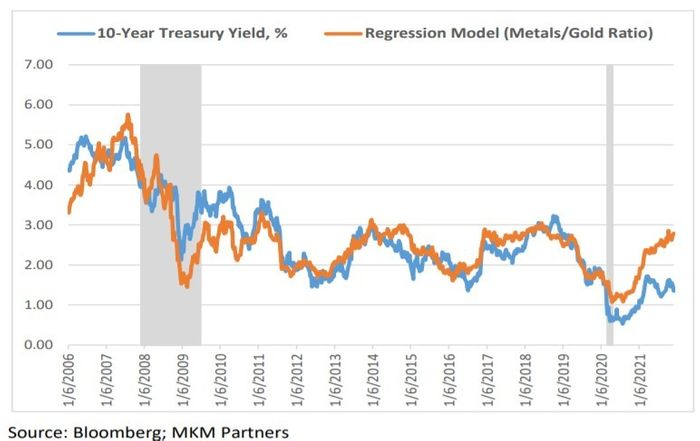

The last time the labor market was near current levels of utilization, real interest rates were 2 percentage points higher, he notes. The breakdown in the relationship between metals and gold, and the 10-year Treasury yield, is more evidence of distortions in the bond market, he adds. "If the bottom were suddenly falling out of global and/or domestic industrial demand, the resilience of metals to gold would be highly unlikely," he says.

Despite monetary policy that is as loose as a goose, Darda still warns that assets that are priced for perfection against record profits and liquidity could falter for any number of reasons, which already is happening for the highest valued names in the Nasdaq-100.

"We continue to take an upbeat view on the reopening stocks which have been crushed and also small cap value," says Darda. "We remain bearish on hyper-valued growth. Back in the old days, high valuations used to mean lower expected future returns. Blinded by liquidity and false expectations of the proverbial Fed put, we fear that some investors are chasing momentum into the graveyard."